1313 – Insurance underwriters

Insurance underwriters review and evaluate insurance applications to determine insurance risks, insurance premiums and extent of insurance coverage according to company policies. They are employed at head and branch offices of insurance companies.

Profile

Example titles

- Group underwriter

- Insurance underwriter

- Liability underwriter

- Property underwriter

Inclusions

- Casualty insurance products analyst-designer

- Insurance rating analyst

Main duties

This group performs some or all of the following duties:

- Review individual and group applications for automobile, fire, health, liability, life, property, marine, aircraft and other insurance

- Evaluate new and renewal applications to determine insurance risks, insurance premiums, extent of insurance coverage and other conditions of the insurance contract using medical reports, rate tables and other documents and reference materials; adjust premiums, coverage or risk itself to make acceptance of new and renewal applications possible

- Approve sale of insurance policies and ensure compliance with government regulations

- Provide recommendations on individual or group insurance plan designs

- Provide underwriting advice and answer inquiries from clients and from insurance agents, consultants and other company personnel

- Prepare underwriting reports and update insurance forms when necessary.

Employment requirements

- Completion of secondary school and some general insurance experience or a bachelor's degree, college diploma or some post-secondary education is required.

- Several years of on-the-job training and completion of insurance industry underwriting courses and training programs are required.

Additional information

- Progression to management positions in the insurance industry is possible with experience.

- Completion of educational programs through the Insurance Institute of Canada or its provincial counterparts entitles insurance underwriters to professional recognition as a Chartered Insurance Professional (CIP) and, with additional university courses, as a Fellow, Chartered Insurance Professional (FCIP).

Exclusions

- Insurance agents and brokers (6231)

Insurance managers (in 0121 Insurance, real estate and financial brokerage managers)

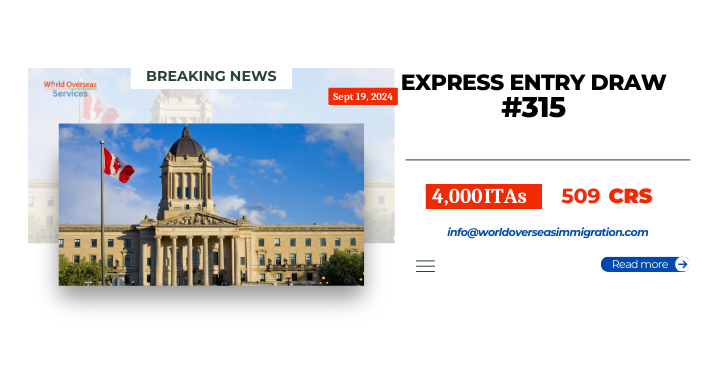

Are you interested in immigrating to Canada, but not sure how to do it? Whether you want to make Canada your temporary or permanent home, it is important to get access to the most up-to-date information. World Overseas Services provide you best guidance, if you have any query you can fill the side bar form or you can call us on 011-41068639 or just mail us your query at query@worldoverseasimmigration.com