0111 – Financial managers

Financial managers plan, organize, direct, control and evaluate the operation of financial and accounting departments. They develop and implement the financial policies and systems of establishments. Financial managers establish performance standards and prepare various financial reports for senior management. They are employed in financial and accounting departments in companies throughout the private sector and in government.

Profile

Example titles

- Controller – financial services

- Director – financial services

- Director of accounting

- Finance director

- Financial administrator

- Financial control manager

- Financial planning and analysis manager

- Internal audit services manager

- Treasurer

Inclusions

- Corporate risk department manager

- Pension plans administrator

- Pension services manager

Main duties

This group performs some or all of the following duties:

- Plan, organize, direct, control and evaluate the operation of an accounting, audit or other financial department

- Develop and implement the financial policies, systems and procedures of an establishment

- Prepare or co-ordinate the preparation of financial statements, summaries, and other cost-benefit analyses and financial management reports

- Co-ordinate the financial planning and budget process, and analyze and correct estimates

- Supervise the development and implementation of financial simulation models

- Evaluate financial reporting systems, accounting procedures and investment activities and make recommendations for changes to procedures, operating systems, budgets and other financial control functions to senior managers and other department or regional managers

- Recruit, organize, train and manage staff

- Act as liaison between the organization and its shareholders, the investing public and external financial analysts

- Establish profitability standards for investment activities and handle mergers and/or acquisitions

- Notify and report to senior management concerning any trends that are critical to the organization's financial performance.

Employment requirements

- A bachelor's degree in business administration, economics, commerce or a related field is required.

- A master's degree in business administration (concentration in finance), or another master's level management program may be required.

- Several years of experience in accounting, auditing, budgeting, financial planning and analysis or other financial activities are required.

- Accounting and audit managers may require a recognized accounting designation (CPA, CA, CPA, CMA or CPA, CGA).

Additional information

Progression to senior management positions, such as vice-president of finance, is possible with experience.

Exclusions

- Banking, credit and other investment managers (0122)

- Managers of accounting and auditing firms (in 0125 Other business services managers)

- Senior managers – financial, communications and other business services (0013)

How to Immigrate to Canada as a Financial managers

In the Canada occupation NOC List, every occupation has assigned a code and the code, for financial manager the NOC code is 0111. This is known as the NOC Code for Financial managers Immigrating to Canada. there are many ways to immigrate to Canada like below:

The code for financial managers on the NOC is 0111

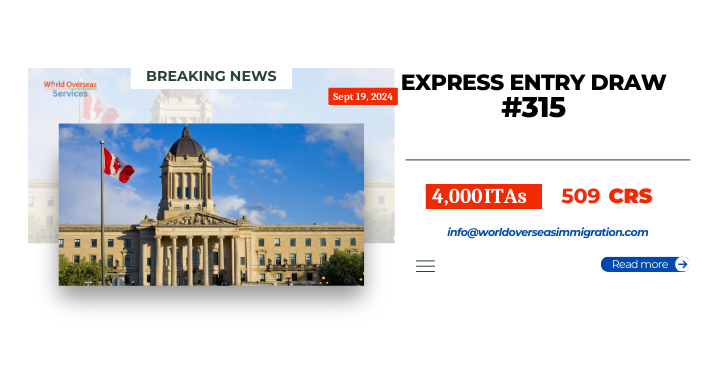

Financial managers are in huge demand in Canada, they are having very good scope in public as well as private sector as well. if you are interested to immigrate to Canada, you just need to check your eligibility. Once you make your mind to move to Canada, always check your points as per the Canada point system.

World Overseas Services provide you best guidance for your immigration. If you have any query you can fill the side bar form or you can call us on +919810366117 or +918448490107 or just mail us your query at info@worldoverseasimmigration.com

How to contact us

Our office is in South Delhi. You can come in the office directly for any immigration process query. But it will be beneficial for you complete your free assessment visa form before the meeting. So that the consultant has all the knowledge about your profile and he can guide you properly.